EUR/USD near 1.2000 ahead of ZEW

The bid tone around the shared currency stays well and sound during the first half of the week, with EUR/USD now edging higher to the 1.1980 region.

EUR/USD focus on ZEW, FOMC

The pair is extending its upside momentum for the fourth consecutive session so far on Tuesday and is trading at shouting distance from the psychological barrier at 1.12000 the figure.

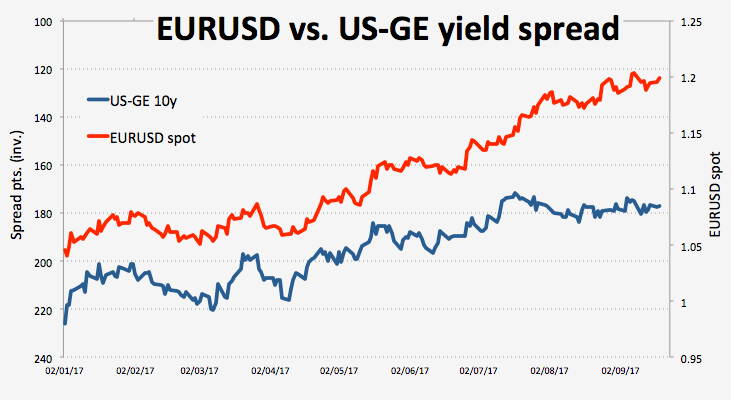

The selling bias around the greenback remains the sole driver of the up move to fresh 6-day peaks, while the US Dollar Index stays entrenched below the 92.00 hanlde amidst rumours and counter-rumours on the potential tax reform by the Trump administration. The up tick in spot comes in spite of the solid rebound of US 10-year yields, which are trading beyond the 2.22% level so far.

Data wise today, the German ZEW survey is expected to improve a tad for the current month, while EMU’s current account is seen ticking higher during July. Across the pond, housing starts, building permits and export/import prices are also due.

EUR/USD levels to watch

At the moment, the pair is up 0.27% at 1.1987 and a break above 1.1995 (high Sep.13) would target 1.2041 (high Sep.11) and finally 1.2092 (2017 high Sep.6). On the flip side, the immediate support aligns at 1.1919 (21-day sma) followed by 1.1851 (5-month support line) and finally 1.1837 (low Sep.14).