When are the US durable goods orders data and how could they affect EUR/USD?

US durable goods orders overview

Thursday's US economic docket highlights the release of durable goods orders data for the month of December - delayed due to the US government shutdown. The US Census Bureau is scheduled to release the monthly report at 13:30 GMT and consensus estimates point to a solid m/m growth of 1.5% as against a 0.7% in November.

Excluding transportation items, core durable goods orders - which tend to have a broader impact than the volatile headline figures, are anticipated to have risen by 0.3% during the reported month as compared to a 0.4% decline recorded previously.

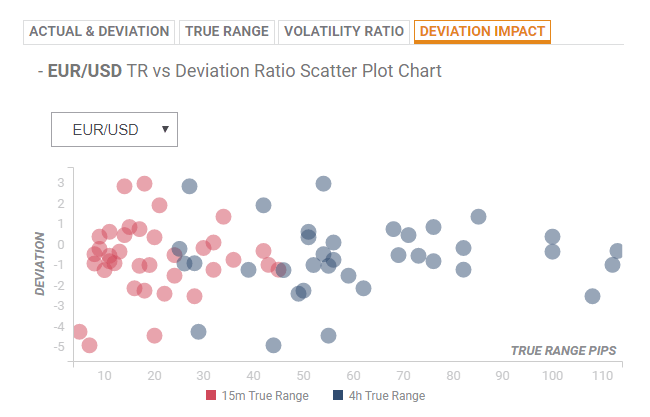

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed, the reaction is likely to be confined between 15 to 25 pips during the first 15-minutes and could extend up to 65-75 pips in the following 4-hours in case of deviations from 0.6 to -1.0. In the last five releases, the pair moved, on average, 12-pips in the 15-minutes after the data release and 40-pips in the following 4-hours.

EUR/USD important levels to watch

Yohay Elam, FXStreet's own Analyst offers some important technical levels ahead of the important release:

"1.1335 capped the pair on Monday and is followed by 1.1372, the peak seen on Wednesday. 1.1390 and 1.1405 supported EUR/USD back in January and serve as resistance lines now."

"Support awaits at 1.1320 which was a low point earlier. 1.1295 provided some support early in the week, and 1.1275 is already more significant: it is the weekly low. Further down, 1.1250 is a double bottom, and the 2019 low of 1.1235 is next down the line," he added further.

Key Notes

• US Durable Goods Preview: Shutdown reporting vs the trend

• EUR/USD Forecast: After failing to rise on good news, is it ready to fall?

• EUR/USD Technical Analysis: The pair faces strong resistance in the 1.1360/1.1400 band

About US durable goods orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.