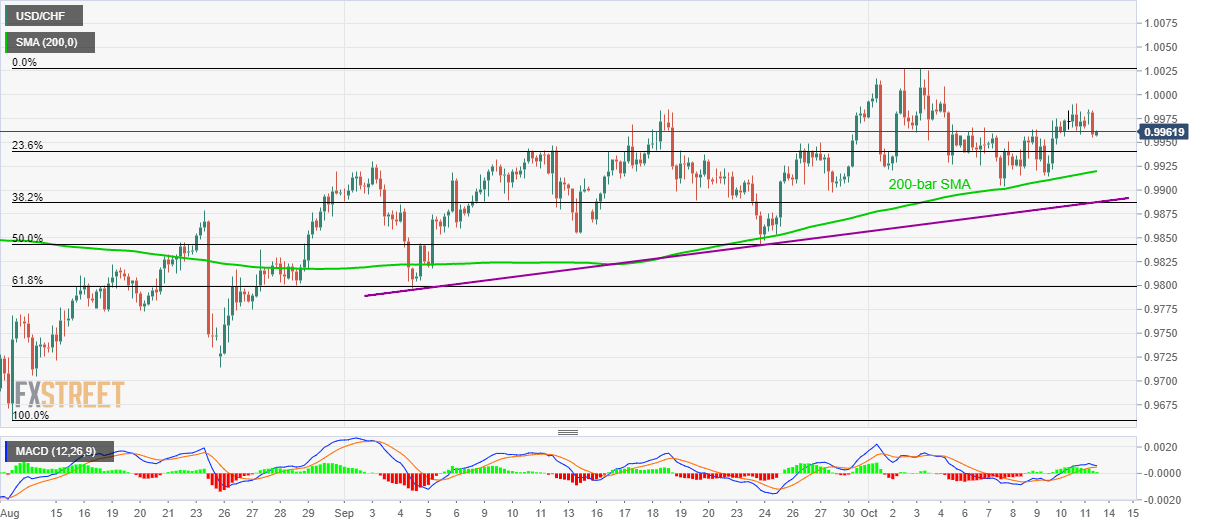

USD/CHF technical analysis: Positive above 200-bar SMA, 0.9890/87 confluence

- USD/CHF pulls back from 0.9990, 23.6% Fibonacci retracement on the sellers’ radar.

- 200-bar SMA, followed by rising multi-week-old rising trendline and 38.2% Fibonacci retracement, limit further declines.

Despite witnessing a downside pressure off-late, the USD/CHF pair remains well above the key supports while taking rounds to 0.9960 amid pre-European open session on Monday.

While 23.6% Fibonacci retracement of August–October upside, at 0.9940, seems to please short-term sellers, 200-bar Simple Moving Average (SMA) around 0.9920, will challenge bears afterward.

If at all prices decline below 0.9920, 0.9890/87 area including an upward sloping trend-line since September 04 and 38.2% Fibonacci retracement will limit further downside, if not then 0.9840 and 0.9800, comprising 61.8% Fibonacci retracement, could gain market attention.

On the contrary, pair’s run-up beyond 0.9990 can again aim for 1.0030 while May-end tops nearing 1.0100 could lure bulls then after.

USD/CHF 4-hour chart

Trend: pullback expected