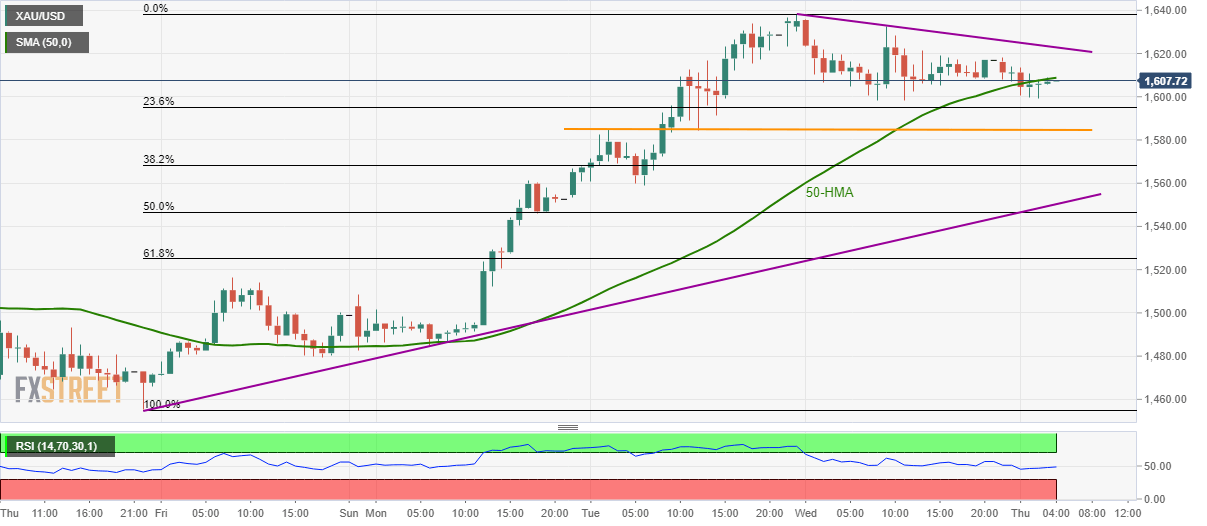

Gold Price Analysis: Probes 50-HMA above $1,600 after US stimulus package news

- Gold struggles to regain the buyers’ confidence.

- The two-day-old descending trend line adds to the resistance.

- A weekly support line could challenge the pullback moves.

- US Senators might be called from the holidays to vote on the Coronavirus Relief Bill.

Despite ticking up to 50-HMA, gold prices paid a little heed to the news that the US COVID-19 Bill is near to being the law. The yellow metal currently takes rounds to $1,606, off from intraday low of $1,599, during the early Thursday.

If at all the bullion manage to clear the $1,608 immediate resistance, a falling trend line from Tuesday, near $1,624, could stop the buyers from targeting the monthly top close to $1,638.

It should also be noted that the metal’s successful rise past-$1,638 could escalate the recovery moves towards $1,660 and $1,680 numbers to the north. Though, the bulls may need validation from $1,640 for the strength.

Alternatively, short-term horizontal support near $1,584 can offer immediate support ahead of the one-week-old rising trend line, around $1,549.

In a case where the sellers dominate past-$1,549, March 20 high near $1,516 could return to the charts.

Gold hourly chart

Trend: Pullback expected