When are the UK CPIs and how could they affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for March month is due early on Wednesday at 06:00 GMT. Following the last month’s surprise drop, coupled with the Bank of England’s (BOE) emphasis on price pressure to dial back the bond purchase, today’s data will be watched closely. Also increasing adding to the figures’ importance is the BOE Governor Andrew Bailey’s scheduled speech around 10:00 AM GMT.

The headline CPI inflation is expected to recover from 0.4% prior to 0.8% on an annual basis while the Core CPI, which excludes volatile food and energy items, is likely to improve from 0.9% previous readouts to 1.1%. Talking about the monthly figures, the CPI could jump from 0.1% to 0.3% during March.

In this regard, analysts at TD Securities said,

March inflation figures are released, and given the sharp downside surprise to last month's figures, there's elevated uncertainty about how quickly prices might rebound. We see mild downside risk to headline inflation at 0.7% y/y (market forecast: 0.8%, BoE: 1.1%) while core inflation registers 1.1% y/y (market consensus: 1.1%).

Deviation impact on GBP/USD

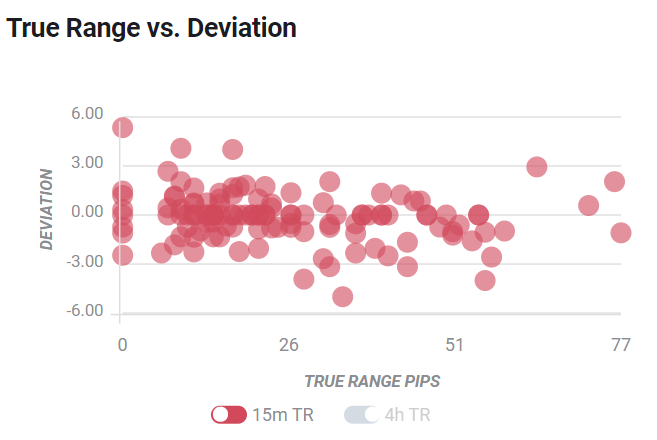

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed, the initial market reaction is likely to remain confined between 15 and 80 pips in deviations up to 2 to -3. The same suggests the importance of the key inflation data for GBP/USD pair traders.

How could it affect GBP/USD?

By the press time of pre-London open on Wednesday, GBP/USD holds lower ground near 1.3930, down 0.7% intraday, while extending the previous day’s pullback from the highest in seven weeks. The US dollar’s broad strength and Brexit jitters supersede the upbeat UK employment data the previous day while also likely to hammer the cable by the press time.

Britain’s easing of activity restrictions post-pandemic, backed by strong vaccination drive, not to forget the heavy stimulus, flashes upside risk for today’s key inflation data. However, any disappointment may not be taken lightly as there prevails a disagreement among the BOE policymakers over the future moves of the “Old Lady”.

Technically, failures to cross the 1.4000 threshold on the daily closing basis keep GBP/USD sellers hopeful but the early-month tops near 1.3920 and the 50-day SMA surrounding 1.3870 should test short-term downside.

Key notes

GBP/USD keeps pullback from one-month top around mid-1.3900s ahead of UK CPI

GBP/USD Forecast: Decreased buying interest hints further near-term slides

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).